June 26, 2017

• 1 Minute Read

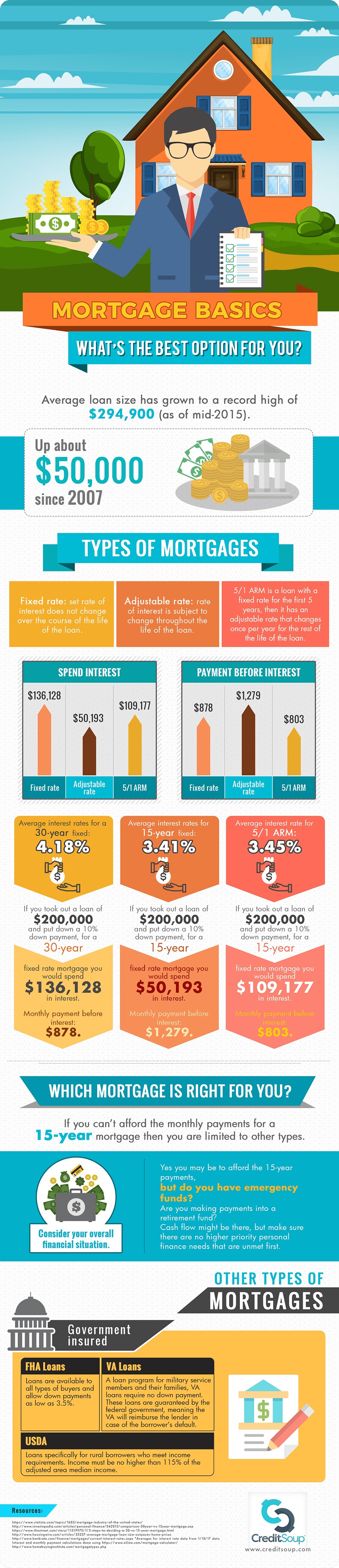

Compared to merely renting, financing an owned residence can be quite the monetary commitment. Luckily, through mortgage loans, homeowners can break the total cost of their home into regular payments over the course of a number of years, taking a fair amount of the immediate financial burden off their back in exchange for accumulated interest over time. In this infographic, you’ll find a rundown on the different types of mortgage loans available to homeowners as well as information on what you can come to expect from these particular loans as the years go by. In addition to that, we’ve also provided information on other options such as FHA loans, VA loans, and USDA loans. Read on to find out more about the different methods you can use to finance your potential new home!

Editorial Disclaimer: Information in these articles is brought to you by CreditSoup. Banks, issuers, and credit card companies mentioned in the articles do not endorse or guarantee, and are not responsible for, the contents of the articles. The information is accurate to the best of our knowledge when posted; however, all credit card information is presented without warranty. Please check the issuer’s website for the most current information.