March 27, 2023

• 3 Minute Read

Self’s main focus is to help you build credit and savings and reach your financial goals. They have over 1 million Builders served and continue to grow. Self isn’t concerned with consumers’ scores, instead they focus on what your financial goals are and help you make those possible. Managing finances shouldn’t be difficult, The Secured Self Visa® Credit Card can help you build credit responsibly while also preparing for the future! Here is a closer look into the Self- Credit Builder Account + Secured Self Visa® Credit Card.

Self offers a path to a credit card for those with little to no credit history. After you open a Credit Builder Account, use the payments you’re already making to fund the security deposit for your credit card. Then you get to choose what portion of your savings progress ($100 or more) is used to secure your card and set your limit. Once you set your limit you order your card and you’re good to go! Be sure to activate your card and then start using wherever Visa® credit cards are accepted in the U.S. Don’t forget to monitor your spending activity and do your best to pay on time and in full.

Let’s break down the path you have to take to get a credit card with Self.

A) Choose a Credit Builder plan that fits your budget and helps you get to the security deposit for the credit limit you can manage in 3 payments. (Keep in mind the minimum is $100 so if you choose the $25 plan*** it may take 4 payments.)

B) Follow these simple steps to unlock your secured Self Secured Visa® Credit Card**

- Make 3 monthly on-time payments

- Have $100 or more in savings progress

- Satisfy income requirements

- Have an account in good standing

C) Use your card to make purchases and continue building your credit!

Card Benefits

Card Benefits include a useful tool for building credit, no additional money up front (other fees may apply when you open a credit builder account but the $25 annual fee due once activated is waived for the first year), and the ability to increase your credit limit by adding more to your security deposit! Remember your Credit Builder Account* savings progress secured your Self Secured Visa® Credit Card** and sets your limit. Accounts in good standing may have opportunities to increase the credit limit over time. A bonus to Self is that they do not do a hard credit pull or a hard credit check, so eligible customers may be able to order the Self Secured Visa® Credit Card as soon as the requirements are met.

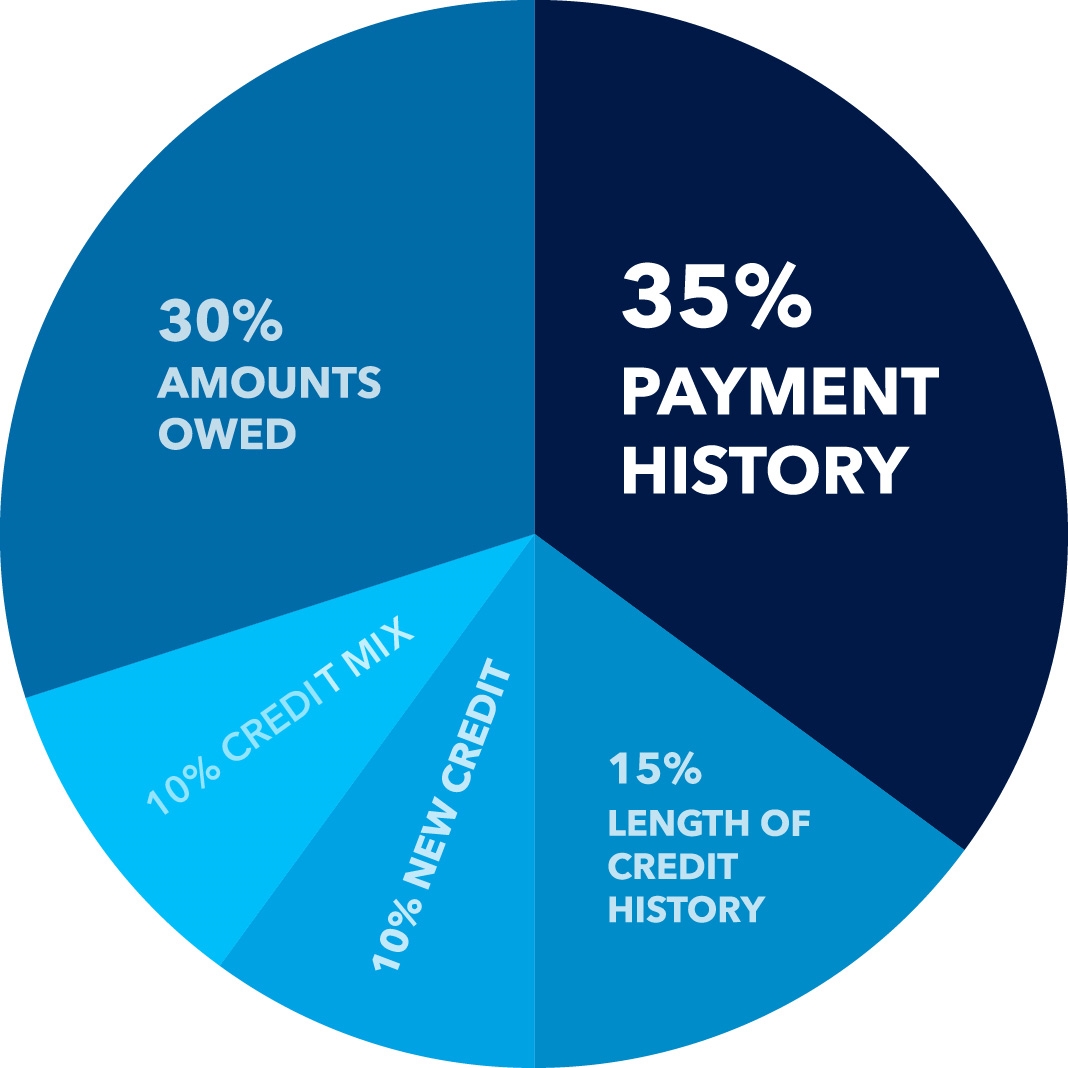

FUN FACT: Did you know that payment history, amounts owed, and credit mix make up 75% of your FICO® credit score?

My FICO.com

FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

A few other things to note, the minimum security deposit for the secured Self Visa® Credit Card is $100**. The The Secured Self Visa® Credit Card also reports to the three major credit bureaus in the U.S. which gives its user the opportunity to build their credit with good financial decisions. The whole mission of Self Financial is to help people build credit and build savings. Their secured Visa® Credit Card could be a great way to build poor credit. Take a look and see if Self is the right fit for you!

*Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval. The secured Self Visa® Credit Card is issued by Lead Bank or First Century Bank, N.A., each Member FDIC. See Self.inc for details. Subject to ID Verification. Individual borrowers must be a U.S. citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. The Secured Self Visa® Credit Card requires an active Self Credit Builder Account and qualification based on other eligibility criteria including income & expense requirements. Criteria subject to change.

**Qualification for the secured Self Visa® Credit Card is based on meeting eligibility requirements, including income and expense requirements and establishment of security interest. Criteria Subject to change. The secured Self Visa® Credit Card is issued by Lead Bank or First Century Bank, N.A., each Member FDIC.

***Sample loans: $25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

Editorial Disclaimer: Information in these articles is brought to you by CreditSoup. Banks, issuers, and credit card companies mentioned in the articles do not endorse or guarantee, and are not responsible for, the contents of the articles. The information is accurate to the best of our knowledge when posted; however, all credit card information is presented without warranty. Please check the issuer’s website for the most current information.