June 5, 2020

• 2 Minute Read

The Chase Ultimate Rewards® Program has been long known for allowing people to redeem points for free flights and hotels. With travel not on people’s minds as much given the current Pandemic situation, Chase® came out with a great new alternative for those points you can be racking up on your Chase® card. It’s called the Pay Yourself Back Program.

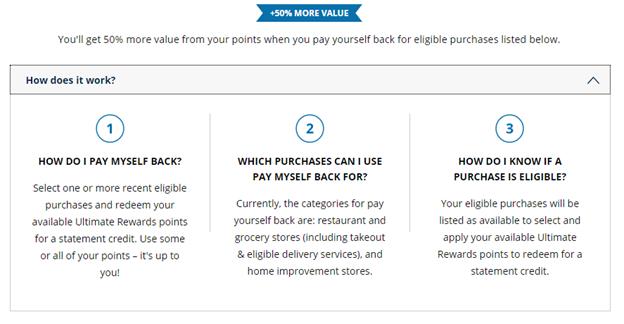

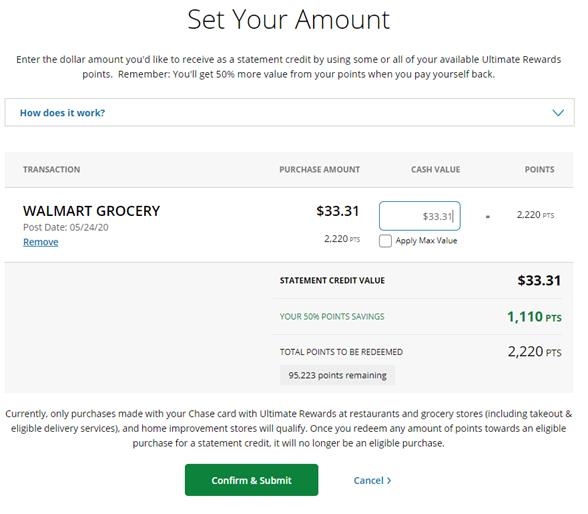

What this program is, is essentially allowing eligible card members the opportunity to now redeem points on the Chase Ultimate Rewards® site to pay for everyday purchases such as groceries, dining and home improvement. You would then select which purchases you’d like to get paid back for and receive the reimbursement for these purchases with a statement credit. This program launched May 31st, starting with Chase Sapphire Reserve® and Preferred® card members allowing points on these types of purchases to be worth between 25-50% more.

One thing to keep in mind, however, is that if you are planning on traveling in the next year, you typically will still get the most out of your points by using them for travel rather than this statement credit option for select everyday purchase categories. For example, if you were to use the Pay Yourself Back option with a Chase Sapphire Reserve® card; Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s amazing! However, using those same 60,000 bonus points could cover the flights for 2 people that may have cost roughly $1,200 total. How you use your points all depends on what your goals and travel plans look like in the upcoming year.

The program is very easy to use. Simply choose from a list of qualified transactions, choose the amount of cash value you want to receive as a statement credit and the credit value will appear on your next card statement.

If you are already a Chase Sapphire Reserve® or Preferred® card holder you can learn more by logging into your Chase Ultimate Rewards® account. New Chase Sapphire Preferred® Card members are also eligible to earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's worth $750 when redeemed through Chase Travel. Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

Editorial Disclaimer: Information in these articles is brought to you by CreditSoup. Banks, issuers, and credit card companies mentioned in the articles do not endorse or guarantee, and are not responsible for, the contents of the articles. The information is accurate to the best of our knowledge when posted; however, all credit card information is presented without warranty. Please check the issuer’s website for the most current information.