Updated On:

February 4, 2026

• 6 Minute Read

It’s that time of year where consumers will be getting their tax returns and looking for the best way to capitalize on that return. Get your federal tax refund up to 5 days early when you direct deposit your tax refund to your Walmart MoneyCard® account1!

Overdraft Protection

Walmart MoneyCard® offers overdraft protection up to $300 with opt-in and eligible direct deposits.2 Not entirely sure what an overdraft is? An overdraft of your account happens when you spend more than what you have available in your account. Walmart MoneyCard® knows life happens, so they offer overdraft coverage to help in those situations.

Rewards

Get rewarded when you shop at Walmart! With the Walmart MoneyCard® you can earn cash back on Walmart purchases- up to $75 each year.3

- 3% at Walmart.com or on the Walmart app3

- 2% at Walmart fuel stations3

- 1% at Walmart stores3

- Activation Fee

- $0

- Monthly Fee

- $0 with eligible direct deposit

- Direct Deposit Fee

- $0

- ATM Fee

- $2.50

- Credit Recommended

- N/A

Highlights

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

- Get peace of mind with three coverage levels, up to $300, for purchase transactions with opt-in & eligible direct deposit.*

*Please see site for full terms and conditions.

How It Works

Shop using your Walmart MoneyCard® at Walmart stores, fuel stations, Walmart.com and on the Walmart app. Earn the above cashback at each of those locations and at the end of the year you can access all your cash back and use it however you want! Just make sure you use your account for at least 12 months

The Walmart MoneyCard® also offers overdraft protection2, no monthly fee4 (when you direct deposit $500+ in previous monthly period,) accounts for your family5 and you can get your pay up to 2 days before payday and your government benefits up to 4 days before benefits day with early direct deposit to your Walmart MoneyCard6

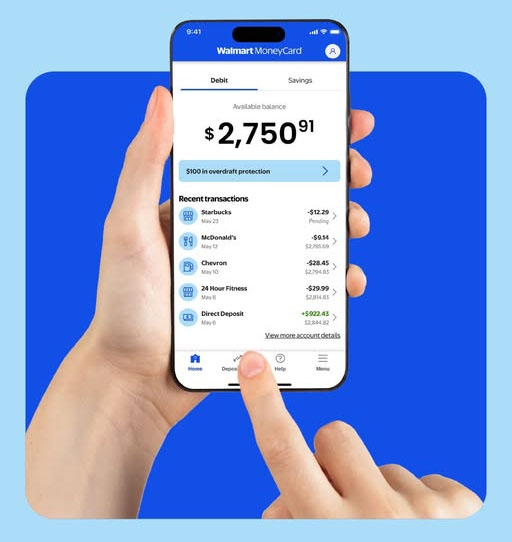

24/7 Access With the App

Manage your money from the palm of your hand. The Walmart MoneyCard app gives you 24/7 access and control of your money from virtually anywhere. It has features like Slide for Balance where, you can take a peek at your account balance with just one swipe! You will also have access to your account history, the ability to make a mobile deposit7, pay bills8, and make cash deposits for free9 using the Walmart MoneyCard app at Walmart stores. Misplaced your card? No worries, press LOCK from the app to temporarily prevent new purchases to your MoneyCard.10 The app also offers the option for bank transfer where you can add money to your Walmart MoneyCard® from another linked bank account.11

Unique Features

The Walmart MoneyCard® offers the unique feature of family accounts. You can add up to 4 additional family members age 13+5, track spending in real-time and easily transfer money between family accounts in the app. The best part is family account members get the same great features and benefits! Turn your family into money management experts with the Walmart MoneyCard®.

1 Early tax refund deposit applies to federal tax returns filed directly with the Internal Revenue Service (IRS) and depends on IRS timing, payment instructions and bank fraud prevention measures. The name and Social Security number on file with the IRS must match your Walmart MoneyCard account to prevent fraud restrictions on the account.

2 Opt-in required. Account must be in good standing and chip-enabled debit card activated to opt-in. Initial and ongoing eligible direct deposits are required for overdraft coverage. Additional criteria may apply which can affect your eligibility and your overdraft coverage. Overdrafts are paid at our discretion. Overdraft fees may cause your account to be overdrawn by an amount that is greater than your overdraft coverage. A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid a fee. Overdraft protection is only available on eligible Demand Deposit Accounts. Log into your account and refer to your Account Agreement to check feature availability.

3 Cash back, up to $75 per year, is credited to card balance at end of reward year and is subject to successful activation and other eligibility requirements. Redeem rewards using our website or app. You will earn cash back of three percent (3%) on qualifying purchases made at Walmart.com and in the Walmart app using your card or your card number, two percent (2%) at Walmart fuel stations, and one percent (1%) on qualifying purchases at Walmart stores in the United States (less returns and credits) posted to your Card during each reward year. Grocery delivery and pickup purchases made on Walmart.com or the Walmart app earn 1%. For the purposes of cash back rewards, a "reward year" is twelve (12) monthly periods in which you have paid your monthly fee or had it waived. See Deposit Account Agreement for details.

4 Monthly fee waived when you direct deposit $500+ in the previous monthly period. Otherwise, $5.94 a month.

5 Activated, personalized card required. Other fees apply to the additional account. Family members age 13 years and over are eligible. Limit 4 cards per account. See Deposit Account Agreement for details.

6 Early direct deposit availability depends on payor type, timing, payment instructions, and bank fraud prevention measures. As such, early direct deposit availability may vary from pay period to pay period. The name and Social Security number on file with your employer or benefits provider must match your Walmart MoneyCard account to prevent fraud restrictions on the account.

7 Active personalized card, limits and other requirements apply. Additional customer verification may be required. Money will be deposited in up to 5 business days.

8 Walmart Bill Pay service may be provided by Green Dot in all 50 states, D.C., and Puerto Rico. Licensed where required as Green Dot Corporation (NMLS #914924) and/or Green Dot Bank (NMLS #908739).

9 Limits apply. Your funds typically become available on your account within 10 minutes for your use.

10 Monthly fees will continue on locked cards. Previously authorized transactions and deposits/transfers to your account will function with a locked card.

11 Transfer money from another U.S. bank to your Walmart MoneyCard. Activated, personalized card required. Limits apply. Subject to your bank's restrictions and fees. Transfers take three (3) business days after account verification. See Deposit Account Agreement for details at WalmartMoneyCard.com

Walmart MoneyCards are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. And by Mastercard International Inc. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Green Dot is a registered trademark of Green Dot Corporation.

Editorial Disclaimer: Information in these articles is brought to you by CreditSoup. Banks, issuers, and credit card companies mentioned in the articles do not endorse or guarantee, and are not responsible for, the contents of the articles. The information is accurate to the best of our knowledge when posted; however, all credit card information is presented without warranty. Please check the issuer’s website for the most current information.