April 26, 2023

• 3 Minute Read

This can be a tough task for some, but if you want to spend wisely, you must remain diligent about sticking to a budget! This week we go over how to stick to a budget.

If you recall an earlier article about tracking your bills, we highlighted 8 apps that help stay on track with budgeting. Now, if you're serious about staying on track to make sure everything is accounted for, down to how much you have left to spend and what to spend it on, here are 3 main options to help you stick to that budget.

#1: Envelope Method

Dave Ramsey explains it best. The envelope system is a way to track exactly how much money you have in each budget category for the month by keeping your cash tucked away in envelopes. At the end of the month, you can see how much cash is left in your envelope. To summarize, here are the 4 steps to get started:

- Think of the budget categories that need a cash envelope: Groceries, Restaurants, Gas, Medicine/pharmacy, Hair care/makeup, Car maintenance, Personal, Entertainment, Gifts, etc.

- Figure out your budget amount.

- Create and fill cash envelopes for the budget categories.

- Spend only what you’ve put in each cash envelope.

However, once the money is gone, it’s gone, so this will force you to stop overspending and help you achieve your money goals faster.

#2: A Budgeting Spreadsheet

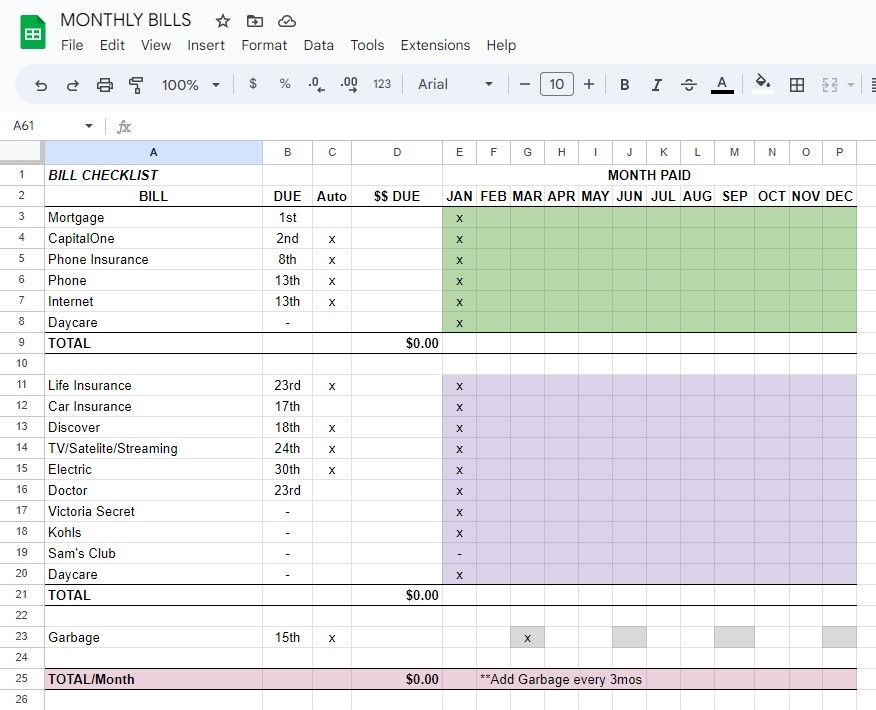

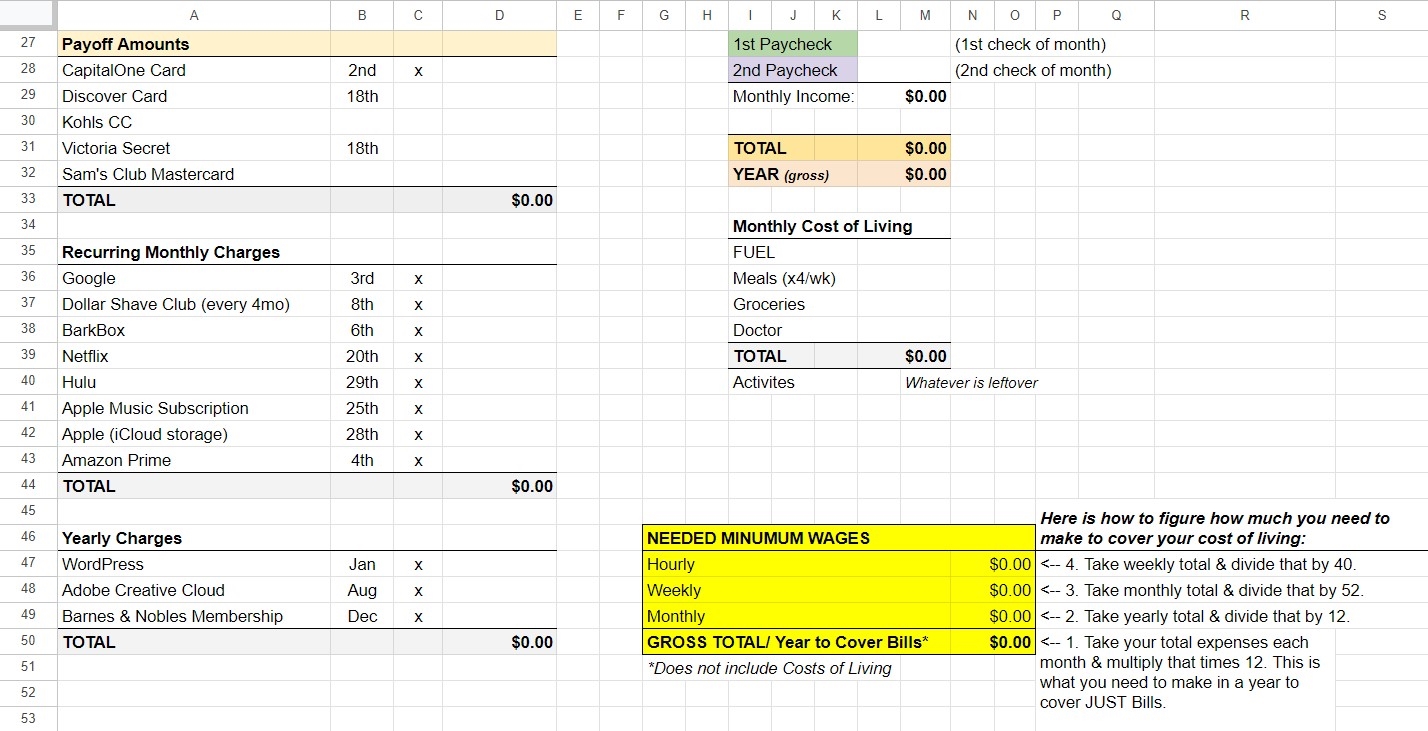

This may seem archaic in today's techie world, but tracking all of your bills & monthly income on a spreadsheet will give you a good start and a great overview of what you have to pay each month, and approximately how much is left over. For example, if you can see that you bring in $3,000/mo and your bills come to $2,400, that means you have $600 left for the month for groceries, gas, entertainment, etc. It also gives you a good look at if you need to cut back on certain things, consolidate some debt, ask for a raise, or get a part time job. If you're not quite sure how to set the spreadsheet up, here are a few screenshots of how this method of madness works for me:

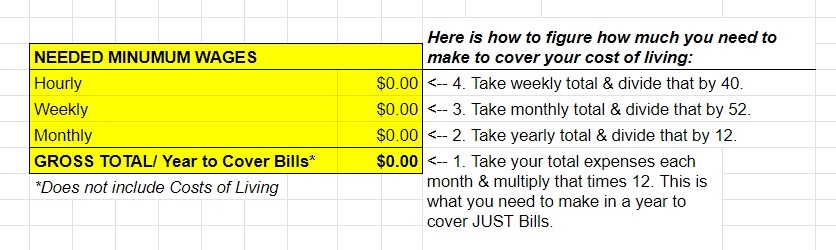

And, by tracking it this way, you can also fine tune - down to the hourly rate - how much you need to make at work, just to be able to pay your bills.

#3: Budgeting Apps

If the envelope method doesn't work for you, and a spreadsheet is way over your head, we might suggest trying a budgeting app. How does a budgeting app work? Once you download a budgeting app, the app helps you track your money. The basic budgeting apps show you how much you earn and organize your expenses into separate categories so that you can see where and how much you spend. CNBC highlights the Top 5 Budgeting apps overall.

Wrapping It Up

Without a budget, you risk spending more than you can afford, ruining your credit, and falling short on savings. Saving money, or setting some aside, is necessary for reaching milestones in life. A milestone can be buying a home, paying off student loans, or even saving for retirement.

Having a budget keeps your spending in check and makes sure that your savings are on track for the future. Budgeting can help you set financial goals, keep you from overspending, and stop bad spending habits. It's a visual plan that shows you where your money goes every month & how much you have left over. Making a budget ensures that you do not run out of money each month, and will help you be prepared for emergencies.

If you're in debt and looking for solutions to dig yourself out, keep following us here at CreditSoup.com for weekly tips on debt management!

Editorial Disclaimer: Information in these articles is brought to you by CreditSoup. Banks, issuers, and credit card companies mentioned in the articles do not endorse or guarantee, and are not responsible for, the contents of the articles. The information is accurate to the best of our knowledge when posted; however, all credit card information is presented without warranty. Please check the issuer’s website for the most current information.